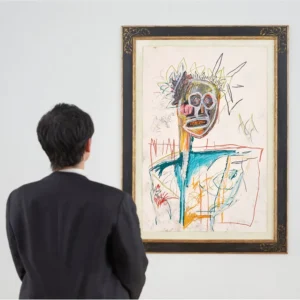

According to a recent Bank of America report, Millennial and Gen Z millionaires maintain more diversified investment portfolios compared to older generations, displaying a strong preference for alternative investments. Over 80% of young millionaires view art as a promising asset class.

The survey was conducted with 1,007 individuals in the US, aged 20-45, with investable assets of at least three million dollars, excluding their primary residence. New generations are at least twice as curious about collecting as their parents, showing interest in watches (46%), wine or spirits (36%), rare or classic cars (32%), sneakers (30%), and antiques (30%).

Self-made wealthy individuals are more inclined toward direct giving, compared to legacy-wealth individuals, who prefer donating to donor-advised funds and charitable trusts. Legacy-wealth individuals place a higher importance on leaving a legacy, often through buying artwork to pass on to future generations. Both groups share a love for researching and learning about art, viewing art purchases as a creative experience.

The findings showed that the art collections of young millionaires are worth more than $100,000. Most are interested in buying new artworks rather than selling existing ones, proving that art is a long-term investment for them.

Unlike real estate and bonds, purchasing artworks allows buyers to demonstrate their values and style, while also investing. Incorporating art into their homes enhances the overall aesthetic experience and showcases their creativity to guests. Young millionaires, who are more interested in philanthropic works and fundraising activities than older generations, aim to support young artists along with their investment interests.

Katy Knox, the president of Bank of America Private Bank, notes that wealthy Americans want to make long-term and meaningful investments, creating a lasting effect with their money. This makes them ideal future patrons of the arts.

Drew Watson, head of Bank of America’s art services, suggests that this trend will stimulate the art market, which began to recover in 2022 after the pandemic. The generational wealth transfer from baby boomers to millennials will support this prediction and contribute to women controlling more wealth, thereby strengthening their role in the art market as patrons.