The contemporary art market is effectively two markets that influence each other: a primary market that focuses on a new work of fine art that emerges from an artist’s studio and is sold to a collector for the first time, typically by a dealer (gallery); and a secondary market that involves the resale of a work already owned or sold by a collector through a dealer (gallery or auction house).

The primary art market is how artists initially sell their work, involving the following participants:

- Galleries, which can be anything from a small neighborhood establishment to a mega gallery, and may focus on exhibitions or mainly hold inventory

- Art Fairs, which are short-term sales events that bring multiple galleries together in a single venue

- Online Platforms, which have especially become more dominant amidst the COVID-19 pandemic, connect collectors with galleries or emerging artists

In today’s market, an artwork created by an artist is rarely sold directly from an artist’s studio to the collector. Galleries or gallery booths at art fairs are the primary venues where art is introduced and promoted to collectors.

Artists aren’t directly involved in the secondary art market. These markets are less prone to change, since there are a limited number of auction houses and secondary galleries, reducing competition. Pricing is determined publicly, through auctions or strong data about comparable sales, instead of privately by the dealer.

The Role of Galleries

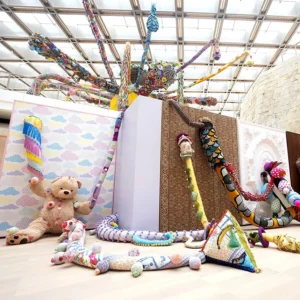

Typically, an artwork makes its debut at a new exhibition. A gallery will organize a vernissage (opening night with the participation of the artist), an event that could be considered the transition of the artist’s work into a commodity. Throughout the exhibition, works are exhibited to public and can be seen for free. At the end of the exhibition, sold works change hands, and unsold works either go into the gallery’s inventory or back to the artist’s studio. Gallerists receive a commission of 40 to 50% on the sold works.

While galleries may appear to simply be playing the role of middleman, the reality is a bit more complicated. In one sense, they serve as patrons or agents for artists. A gallery typically represents from five to a hundred artists, pricing their works and promoting them artists through exhibitions/catalogues. Depending on the relationship, they may also financially back them up and connect them with the wider art community (curators, critics, museums).

Galleries also serve as advisors for collectors, learning and responding to the taste of their collectors, educating them about artists, giving second opinions and advising them about the market. They also act as guarantors for the quality and authenticity of the work sold. All this makes the role of galleries in the art market much more complex than simply acting as a middleman between artists and collectors.

Understanding the Complexities of the Art Market

There are three specific elements that make the contemporary art market unique:

- Why collectors invest in fine art

- How the pricing process works

- The nature of interactions among parties

Why Collectors Buy and Sell Art

An art collector‘s profile, behavior and decision-making process are more complex than those of a typical consumer in other markets.

Some general numbers based on market observation show that most collectors aren’t especially aware of the trends and market forces within the art world. Of those collectors who tend to invest in contemporary art, only about 5% are extremely knowledgeable about art and can sniff out trends in the market. 15% follow the market, potentially acting primarily as flippers rather than as experts with interest in the art itself. The remaining large majority are collectors who simply go after names and don’t actually know what is going on in the art world or the market.

Art investors buy a particular piece for a variety of reasons: its aesthetic value, the way it fits into a collection or an interior design plan; the social status that the possession of the piece conveys; or simply as a sound economic investment.

The traditional reasons to sell are the three Ds: death, debt and divorce. Some collectors may also offload their collections through a loan, rental or trade for tax purposes.

How Fine Art is Priced

Pricing is a conversation between the gallerist and artist, and it’s highly subjective, but there are some unique metrics that influence the final price tag on an artwork: the size and technique of the work and the overall reputation of the artist, including their age, residence and career body of work. Sometimes a high price can be interpreted as signal of quality, and sometimes it can be ridiculed as symbol of fraud.

Exhibitions play an important role in artists’ careers: exhibition in a gallery or museum can act as a seal of approval, offering a strong signal of quality to buyers, increasing prices in subsequent sales.

Finally, there is high volatility and unpredictability in the market: the value of a contemporary piece may fall to 50% of the purchase price.

The Nature of Interactions in the Art World

The traditional art market can come across as opaque and inapproachable. In some instances, casual conversations behind closed doors determine the faith of handshakes. There may be gifts, favors and even sometimes shadowy dealings.

Given these three elements that make the art market unique, it’s easy to conclude that the primary contemporary art market is an inefficient market, where prices don’t clearly reflect available information. In fact, it has been academically argued that it is structurally impossible for this market to be efficient.

Investing in art, therefore, is a complicated subject. Contrary to popular belief about market returns in financial circles, research has led to the argument that art isn’t ideal as an investment vehicle. Investing in paintings or other fine art has transaction and insurance costs, as well as the risk of physical damage that greatly reduces a work’s value. Theft and forgery are also notable concerns. Investors should be cautious about using fine art as an investment unless they have ability to choose art that is likely to appreciate in value.

However, exceptional art pickers do exist, and investing in art can be worthwhile, especially if it’s also a source of enjoyment. Ultimately, there is a lot of joy to be found in owning art for its own sake. The complexities of the art market shouldn’t scare people off. Instead of treating art as a financial investment, people should purchase art that they love for what it is.