The Art Basel and UBS Survey of Global Collecting highlights a rising interest in emerging and women artists in the art market. Most high-net-worth collectors are purchasing from new dealers, with over 75% acquiring paintings and a notable increase in works on paper, which climbed to over 50%.

In the first half of 2024, public auction sales fell by 26% compared to 2023, with major houses like Christie’s, Sotheby’s, Phillips, and Bonhams underperforming pre-pandemic levels. However, mid-market auctions showed relatively stronger results.

Despite the auction slowdown, global art and antique imports rose for the third consecutive year, reaching $33 billion, with steady demand in regions like Hong Kong. In contrast, art exports declined by 1% to $32 billion in 2023, continuing to drop into early 2024, particularly in the US and UK.

In 2023, spending on art and antiques by HNWIs decreased, with average expenditure down 32% to $363,905. Millennials saw the largest drop, with spending down 50% to $395,000, while Gen X had the highest average at $578,000. HNWIs from Mainland China maintained the highest median expenditure at $97,000.

In 2023 and the first half of 2024, over 75% of HNWIs purchased paintings, with works on paper rising from 33% in 2022 to over 50% in 2023, and prints reaching 35%. This shift boosted lower-end market sales as demand for high-priced pieces declined.

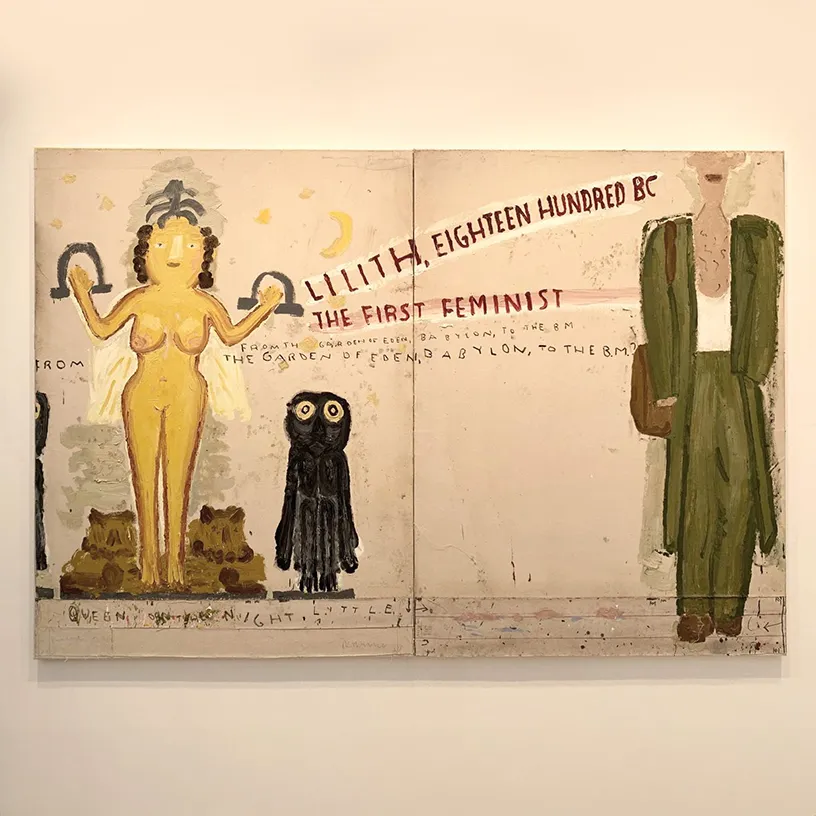

HNWIs favored new and emerging artists, allocating 52% of their spending to them, while mid-career and top-tier artists experienced declines. Female artists represented 44% of HNWI collections in 2024, the highest in seven years, with top spenders allocating 52% of their budgets to female artists.

In early 2024, dealers became the primary purchasing channel for HNWIs, with 95% buying through galleries, online platforms, social media, or art fairs. Dealers employed a multichannel approach: 72% of HNWIs purchased through dealers’ websites, 61% via email or phone, and 43% on Instagram. Overall, dealers accounted for 60% of HNWI spending, distributed as follows: 28% in galleries, 25% online, 18% at art fairs, 18% via email or phone, and 11% on Instagram.

In 2023 and 2024, 88% of HNWIs purchasing through dealers bought from at least one new gallery, engaging with an average of 17-18 galleries, up from 13 in 2019. A strong home bias emerged, with 70% of purchases from local galleries in 2024, up from 50% in 2022.

HNWI portfolio allocations to art declined from 24% in 2022 to 15% in 2024, though the wealthiest (over $50M) still allocated around 25%. An estimated $6 trillion is expected to be transferred to heirs and charities over the next 20-30 years, with 91% of HNWIs holding inherited works, 72% of which are retained in collections.

In 2023, HNWIs attended an average of 49 art-related events and plan to attend about 46 in 2024, an increase from 2019. For 2025, 92% expect to continue attending exhibitions, with nearly half hoping to increase attendance. Plans to buy art have slightly declined, with 43% intending to purchase in the next year, while intentions to sell have risen to 55%. Mainland China shows strong buying interest, with twice as many potential buyers as sellers.

The Art Basel VIP survey of more than 1,400 collectors found that 73% of their art spending in 2023 and 2024 occurred through dealers, while 26% was through art fairs and only 12% through auctions. Almost all collectors (97%) plan to purchase art in the next 12 months, showing strong interest in paintings (91%), sculptures (61%), and works on paper (55%). In contrast, fewer collectors intended to buy design works (20%) or jewelry and watches (11%).