It’s been a wild year for the art market. As auction houses and galleries continue to deal with an ongoing pandemic, the rise of the delta variant, and an uncertain financial future, the market has made a lot of shifts.

To make sense of it all, we’ve brought together art auction results from recent seasons, a few eye-opening prices, as well as predictions for fine art market trends.

Contemporary Art Auctions After COVID-19 Lockdowns

2020 as a whole was a dismal year for auction sales. Sales topped out at $10.1 billion total across all major houses. For perspective, that’s 25% less than 2019 and the worst annual total in over ten years.

After an absolutely anemic first half of 2020, auctions did begin to spring back in October, when total art auction sales among the major houses almost hit $2.5 billion for the month. As COVID-19 restrictions began to ease and in-person bidding began to resume, the market benefitted.

A major saving grace for auction houses was the move online. Sotheby’s, Christie’s, and Phillips sold about $1 billion worth in online-only sales, by far the highest ever.

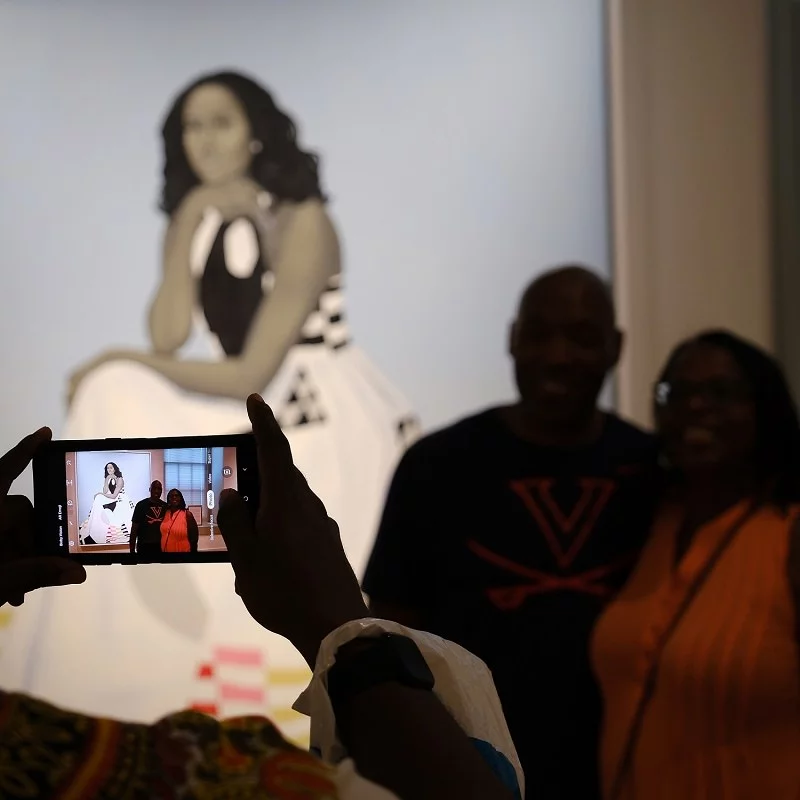

As auctions began heating up at the end of the year, there were some notable works going for surprising sums. Amy Sherald’s The Bathers (2015) sold for over $4 million, blowing past the $150,000 to $200,000 estimate.

Sherald’s big success so early in her career is part of what Scott Reyburn coined the “red chip art phenomenon.” Today, younger artists are able to gather tremendous amounts at auction, sums that used to be reserved for only the most established names.

Some commentators worry that this increase in red chip art will see a long-term decrease in blue chip art (those pieces with a longer history). That could undermine the logic behind investing in contemporary art, upending a decades-long model of art buying.

Beginning a New Year in the Art Market

In early 2021, we saw NFTs arrive in the headlines as they began commanding huge prices at auction. For instance, Christie’s sold Beeple’s Everydays: The First 5000 Days for a jaw dropping $69 million. That makes him the third most expensive artist alive right now. Who is the most expensive living artist? Jeff Koons, who reached the top of the list when his statue Rabbit sold for $91 million at Christie’s in 2019.

In other big seller news, Banksy generated the most money at auction this year of any living artist, skyrocketing 80% from last year to reach $125.4 million.

Spring 2021 saw a return to major auction action, with Phillips having one of its best seasons ever thanks in part to four successful events in Hong Kong and the arrival of NFTs. We also bore witness to Greater China’s dominance over the auction market as their wealth moves toward art collecting, a trend that will likely only continue to gain momentum. It now makes up a whopping 36% of public auction sales by value.

While many people suffered economically over 2020, the richest echelons of society actually got richer. So despite turbulent economic waters, the major auction houses that cater to the richest art buyers bounced back easily.

Art Market Trends 2021 & Beyond

With 2020 came the closure of a lot of galleries, along with the rise of online-only auctions. This has pushed the art market kicking and screaming into the digital realm.

While COVID-19 restrictions have been lifted in some places, low vaccination rates and a rise in delta variant infections in major markets like the US might see new waves of restrictions. That will mean more reliance on online auctions next year.

The digital shift in 2020 has created lasting changes that are here to stay. That change is bolstered by new generations of artists and art buyers eager to buy and sell online. At the same time, many traditional galleries shuttered their doors in 2020. To navigate this new terrain, traditional institutions are relying on phygital solutions, blending online applications with in-person experiences to provide services on both fronts.

This proliferation of online options is disrupting the traditional art auction calendar. Phillips now runs Gallery One, an online auction platform that allows for irregular auctions, and provides more opportunity to buy lower ticket items.

What is the final picture? Digital solutions are changing the market in big ways, just as the influence of Greater China is making its presence felt. Along with this, a generational shift in how artists sell work and buyers purchase it are eroding the age-old gallery pipeline, and NFTs are creating new ways of “owning” art. A new emphasis on red chip art could have massive implications for those looking to buy fine art as an investment. All of these trends come together to tell a single story: the art market is in flux, and it isn’t slowing down anytime soon.